(Bloomberg) — Oil rallied, briefly nearing $80 a barrel in London, as the market waited to see if Israel would retaliate against Tehran for a missile attack last week.

Most Read from Bloomberg

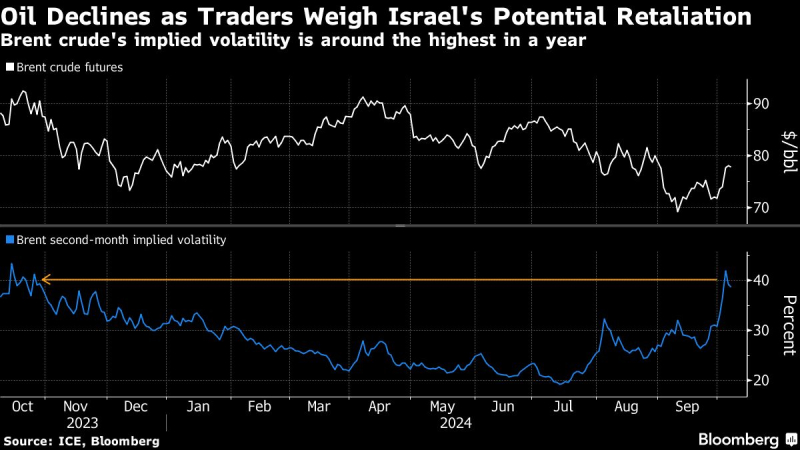

Brent rose as much as 2.4%, after jumping the most since January 2023 last week, while West Texas Intermediate surpassed $75. US President Joe Biden said on Friday that he didn’t know when an Israeli response would come, but “I’d be thinking about other alternatives than striking oil fields.”

Iran’s attack on Israel has raised fears over an all-out war in the Middle East, and prompted a flurry of action in the options market. Still, questions about the demand outlook — especially from No. 1 importer China — and plentiful supply continue to hang over the market.

“All attention is once again on the Middle East, especially whether there will be a military response from Israel following last week’s Iranian missile attack,” said Arne Lohmann Rasmussen, Chief Analyst at A/S Global Risk Management.

Global markets have also been re-pricing the outlook for Federal Reserve interest rate cuts after a blowout jobs report on Friday. Traders no longer see another half-point reduction in rates this year amid concerns that the US economy will continue growing and reignite inflation, leaving little room to cut.

The Middle East remains on edge, with Israel sending troops back into northern Gaza over the weekend and keeping up aerial attacks and limited ground maneuvers in Lebanon. Iran’s oil output has returned to almost full capacity and could be vulnerable as tensions escalate.

Options markets for oil continue to retain their bias toward bullish calls — which profit buyers when futures gain. A gauge of implied volatility for Brent was near the highest level in almost a year, while money managers have added more net-long positions for the global benchmark.

Goldman Sachs Group Inc. predicted Brent could surge to the $90s if Iran’s oil supply is disrupted, according to a note from analysts including Daan Struyven. However, JPMorgan Chase & Co. said attacking Tehran’s energy facilities wouldn’t be the preferred course of action.

China’s top economic planner will hold a press briefing on Tuesday to discuss a package of policies aimed at boosting economic growth, according to a notice from the government on Sunday. Expectations are rising among analysts for Beijing to expand public spending as part of its stimulus package.

“Oil is seeing primarily momentum-driven buying, with focus on the Middle East as well as tomorrow’s press conference in China by top economic planners,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.